ETH Price Prediction: Navigating Technical Resistance and Fundamental Crosscurrents

#ETH

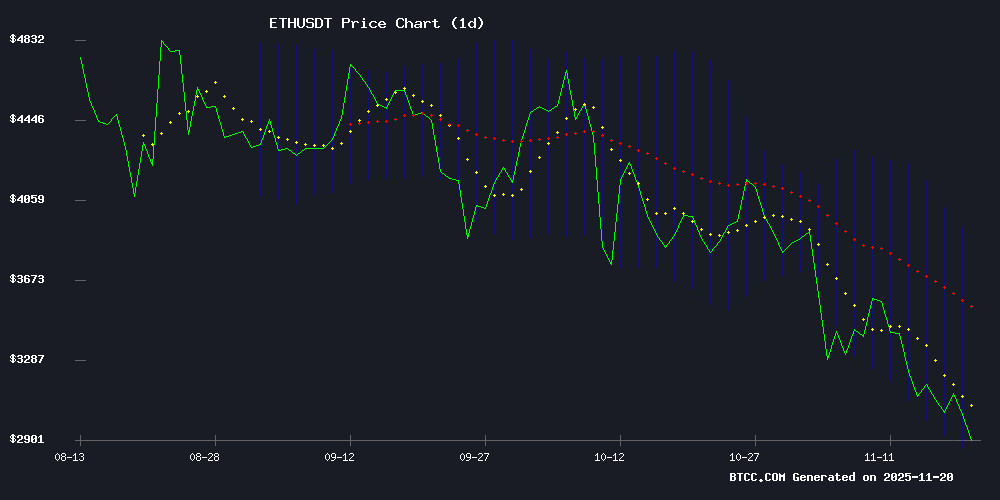

- ETH trading 9.6% below 20-day moving average at $3,352.47, indicating technical weakness

- MACD bearish divergence at -39.47 suggests momentum remains negative despite oversold conditions

- Conflicting fundamental signals between institutional risks and DeFi expansion creating market uncertainty

ETH Price Prediction

Technical Analysis: ETH Trading Below Key Moving Average

According to BTCC financial analyst William, ethereum is currently trading at $3,029.40, significantly below its 20-day moving average of $3,352.47. The MACD indicator shows bearish momentum with a reading of -39.47, while price action near the lower Bollinger Band at $2,840.75 suggests potential oversold conditions. William notes that a sustained break above the 20-day MA could signal trend reversal, while failure to hold the lower band support may lead to further downside.

Mixed Market Sentiment Amid Institutional Developments

BTCC financial analyst William points to conflicting signals in Ethereum's fundamental landscape. While Vitalik Buterin's warnings about institutional risks to decentralization create headwinds, expansion of DeFi services by Coinbase and strategic accumulation by Bitmine provide counterbalancing positive catalysts. William suggests the market is digesting both regulatory concerns and institutional adoption simultaneously, creating a complex sentiment environment that aligns with the current technical consolidation phase.

Factors Influencing ETH's Price

Wallet Breach Hits Trump-Linked WLFI Crypto Venture Ahead of Launch

A security breach targeting wallets tied to the Trump-affiliated World Liberty Financial (WLFI) crypto project has forced emergency measures just days before its scheduled launch. Attackers exploited phishing schemes and compromised private keys, leading to unauthorized access to 272 user wallets.

The company froze affected accounts and implemented identity verification protocols to return recovered funds. WLFI attributed most compromises to credential exposure and malicious contracts linked to Ethereum's EIP-7702 Pectra upgrade. New smart contract logic has been deployed to mitigate further risks.

Notably, the incident underscores persistent vulnerabilities in third-party crypto tools. WLFI's response highlights the tension between rapid innovation and security in blockchain ventures—particularly those with high-profile political affiliations.

Vitalik Buterin Warns of Institutional Risks to Ethereum's Decentralization

Ethereum co-founder Vitalik Buterin has raised alarms over the growing influence of institutional players like BlackRock on the network's future. Speaking at Devconnect in Buenos Aires, Buterin highlighted the existential risks posed by Wall Street's accelerating accumulation of ETH, which now approaches 10% of circulating supply.

Nine major U.S. ETF issuers currently hold over $18 billion in Ether, with corporate treasuries controlling comparable amounts. While acknowledging institutional participation brings liquidity and legitimacy, Buterin warned of fundamental value misalignment. "Speed and financial optimization drive Wall Street," he noted, "not decentralization or censorship resistance."

The Tor Project's Roger Dingledine joined Buterin in cautioning against protocol changes that might prioritize institutional expectations over Ethereum's Core principles. Their concerns emerge as traditional finance increasingly views ETH as a strategic asset, potentially reshaping the network's development trajectory.

Coinbase Expands DeFi Mullet Service to Brazil, Streamlining Onchain Trading

Coinbase is extending its DeFi Mullet service to Brazil, following its successful U.S. launch in October. The feature integrates decentralized exchange (DEX) trading directly into the Coinbase app, eliminating technical barriers for retail users. CEO Brian Armstrong emphasized the growing accessibility of onchain trading, noting strong demand from American users.

The service aggregates liquidity from top DEXs like Uniswap and Aerodrome while maintaining self-custody wallet functionality. No network fees are charged for trades, though the Brazilian rollout date remains unspecified. Crypto community reactions have been largely positive, with some suggesting tighter integration with Coinbase's Base app could enhance the offering.

Bitmine Accumulates Ethereum Amid Market Downturn, Signaling Long-Term Confidence

Ethereum has faced significant selling pressure as the broader cryptocurrency market enters a corrective phase. Despite the volatility, ETH has held above the critical $3,000 level—a threshold many analysts view as vital for maintaining bullish momentum. Market observers now suggest a potential recovery may be underway, with institutional accumulation reinforcing the narrative.

Bitmine, the crypto investment firm co-founded by Wall Street strategist Tom Lee, has continued acquiring ETH even as prices declined. On-chain data reveals a recent transfer of 21,054 ETH to a new wallet, underscoring institutional conviction in Ethereum's long-term value. This contrasts sharply with retail investors, who have largely capitulated during the downturn.

Tom Lee, a vocal advocate for both Bitcoin and Ethereum, has shaped digital asset market sentiment for nearly a decade. Bitmine's strategy focuses on strategic accumulation during periods of fear, positioning itself as a contrarian force in the space. The firm's latest moves suggest confidence in Ethereum's resilience despite short-term market weakness.

Ethereum Whales Diversify as Mutuum Finance Presale Nears Sellout

Ethereum's market dynamics hint at brewing volatility. Exchange reserves have plummeted from 27 million to 15.9 million ETH - a structural supply drain that historically precedes supply-shock rallies. When demand returns to a supply-constrained market, the resulting price movements tend to be rapid and pronounced.

Meanwhile, sophisticated investors are quietly reallocating portions of their ETH holdings toward emerging projects showing early traction. Mutuum Finance has captured particular attention, with its Phase 6 presale exceeding 90% subscription at $0.035 per token. The project now flirts with the psychological $1 valuation threshold that often triggers retail investor participation.

How High Will ETH Price Go?

Based on current technical and fundamental analysis, BTCC financial analyst William projects Ethereum could target the $3,350-$3,400 range in the near term, representing approximately 10-12% upside from current levels. However, this outlook depends on several key factors aligning positively.

| Price Target | Probability | Key Conditions |

|---|---|---|

| $3,400 | Medium | Break above 20-day MA, sustained DeFi growth |

| $3,200 | High | Consolidation above $3,000, reduced regulatory concerns |

| $3,600 | Low | Strong institutional adoption, MACD bullish crossover |

William emphasizes that while current technicals suggest near-term resistance around the moving average, fundamental developments in DeFi expansion and institutional accumulation provide underlying support for gradual recovery toward previous resistance levels.